\(\ell_1\) trend filtering¶

A derivative work by Judson Wilson, 5/28/2014. Adapted from the CVX example of the same name, by Kwangmoo Koh, 12/10/2007

Topic Reference:

S.-J. Kim, K. Koh, S. Boyd, and D. Gorinevsky, ``l_1 Trend Filtering’’ http://stanford.edu/~boyd/papers/l1_trend_filter.html

Introduction¶

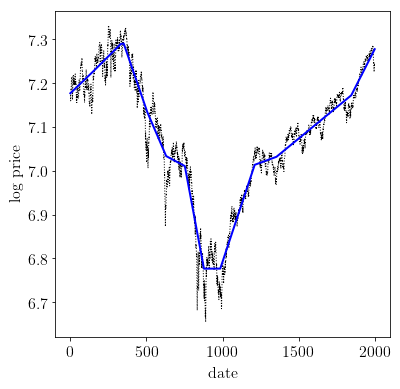

The problem of estimating underlying trends in time series data arises in a variety of disciplines. The \(\ell_1\) trend filtering method produces trend estimates \(x\) that are piecewise linear from the time series \(y\).

The \(\ell_1\) trend estimation problem can be formulated as

with variable \(x\) , and problem data \(y\) and \(\lambda\), with \(\lambda >0\). \(D\) is the second difference matrix, with rows

CVXPY is not optimized for the \(\ell_1\) trend filtering problem. For large problems, use l1_tf (https://www.stanford.edu/~boyd/l1_tf/).

Formulate and solve problem¶

import numpy as np

import cvxpy as cp

import scipy as scipy

import cvxopt as cvxopt

# Load time series data: S&P 500 price log.

y = np.loadtxt(open('data/snp500.txt', 'rb'), delimiter=",", skiprows=1)

n = y.size

# Form second difference matrix.

e = np.ones((1, n))

D = scipy.sparse.spdiags(np.vstack((e, -2*e, e)), range(3), n-2, n)

# Set regularization parameter.

vlambda = 50

# Solve l1 trend filtering problem.

x = cp.Variable(shape=n)

obj = cp.Minimize(0.5 * cp.sum_squares(y - x)

+ vlambda * cp.norm(D*x, 1) )

prob = cp.Problem(obj)

# ECOS and SCS solvers fail to converge before

# the iteration limit. Use CVXOPT instead.

prob.solve(solver=cp.CVXOPT, verbose=True)

print('Solver status: {}'.format(prob.status))

# Check for error.

if prob.status != cp.OPTIMAL:

raise Exception("Solver did not converge!")

print("optimal objective value: {}".format(obj.value))

pcost dcost gap pres dres k/t

0: 0.0000e+00 -1.0000e+00 1e+05 1e-01 4e-02 1e+00

1: 2.2350e-01 1.5374e-01 8e+03 8e-03 3e-03 7e-02

2: 1.9086e-01 2.3346e-01 1e+03 1e-03 4e-04 6e-02

3: 3.9403e-01 4.4110e-01 7e+02 7e-04 3e-04 6e-02

4: 3.5979e-01 4.1278e-01 3e+02 3e-04 1e-04 6e-02

5: 6.4154e-01 6.4522e-01 2e+01 2e-05 7e-06 4e-03

6: 9.0480e-01 9.0710e-01 1e+01 1e-05 4e-06 3e-03

7: 9.9603e-01 9.9825e-01 1e+01 1e-05 4e-06 2e-03

8: 1.0529e+00 1.0542e+00 6e+00 6e-06 2e-06 1e-03

9: 1.1994e+00 1.2004e+00 4e+00 4e-06 2e-06 1e-03

10: 1.2689e+00 1.2693e+00 2e+00 2e-06 6e-07 4e-04

11: 1.3728e+00 1.3729e+00 5e-01 5e-07 2e-07 1e-04

12: 1.3802e+00 1.3803e+00 2e-01 2e-07 9e-08 6e-05

13: 1.3965e+00 1.3965e+00 1e-01 1e-07 4e-08 3e-05

14: 1.3998e+00 1.3998e+00 3e-02 3e-08 1e-08 8e-06

15: 1.3999e+00 1.3999e+00 3e-02 3e-08 1e-08 7e-06

16: 1.4011e+00 1.4011e+00 9e-03 9e-09 3e-09 2e-06

17: 1.4013e+00 1.4013e+00 3e-03 3e-09 1e-09 8e-07

18: 1.4014e+00 1.4014e+00 6e-04 6e-10 3e-10 2e-07

19: 1.4014e+00 1.4014e+00 2e-04 2e-10 7e-11 4e-08

20: 1.4014e+00 1.4017e+00 4e-05 4e-11 2e-08 1e-08

21: 1.4014e+00 1.4015e+00 3e-06 4e-12 8e-08 7e-10

22: 1.4014e+00 1.4013e+00 4e-08 4e-13 2e-08 9e-12

Optimal solution found.

Solver status: optimal

optimal objective value: 1.4014300716775199

Results plot¶

import matplotlib.pyplot as plt

# Show plots inline in ipython.

%matplotlib inline

# Plot properties.

plt.rc('text', usetex=True)

plt.rc('font', family='serif')

font = {'weight' : 'normal',

'size' : 16}

plt.rc('font', **font)

# Plot estimated trend with original signal.

plt.figure(figsize=(6, 6))

plt.plot(np.arange(1,n+1), y, 'k:', linewidth=1.0)

plt.plot(np.arange(1,n+1), np.array(x.value), 'b-', linewidth=2.0)

plt.xlabel('date')

plt.ylabel('log price')

Text(0, 0.5, 'log price')